by Chris Nicholson | Jan 3, 2019 | Blog, Group Insurance

Sales goals, service goals, project goals and so many more goals that businesses often create this time of year. Are we doing better than last year? We’ve been part of many conversations with our clients about their goals for their business. We love talking to...

by Chris Nicholson | Oct 19, 2018 | Blog, EAP, Small Business

It can be difficult to separate personal challenges from your day-to-day work life. The Arive® Employee Assistance Program – included in some benefits packages – gives you access to qualified professionals who can help you handle situations impacting your emotional...

by Chris Nicholson | Oct 16, 2018 | Blog, Small Business

Often someone who starts a business is employed. Having come up with a great new idea, seeing an opportunity or just looking to change pace of their current life. Many times the decision to leave the organization you are part of can be a difficult decision to make. ...

by Chris Nicholson | Jul 10, 2018 | Drugs, Uncategorized

80% of the claims made in most employee benefits are for prescription drugs. Prescription drugs play an important part in good health care of plan members and their families, Here are some simple and easy things to do to make sure you are saving yourself some money...

by Chris Nicholson | Jan 5, 2018 | Blog, Group Insurance

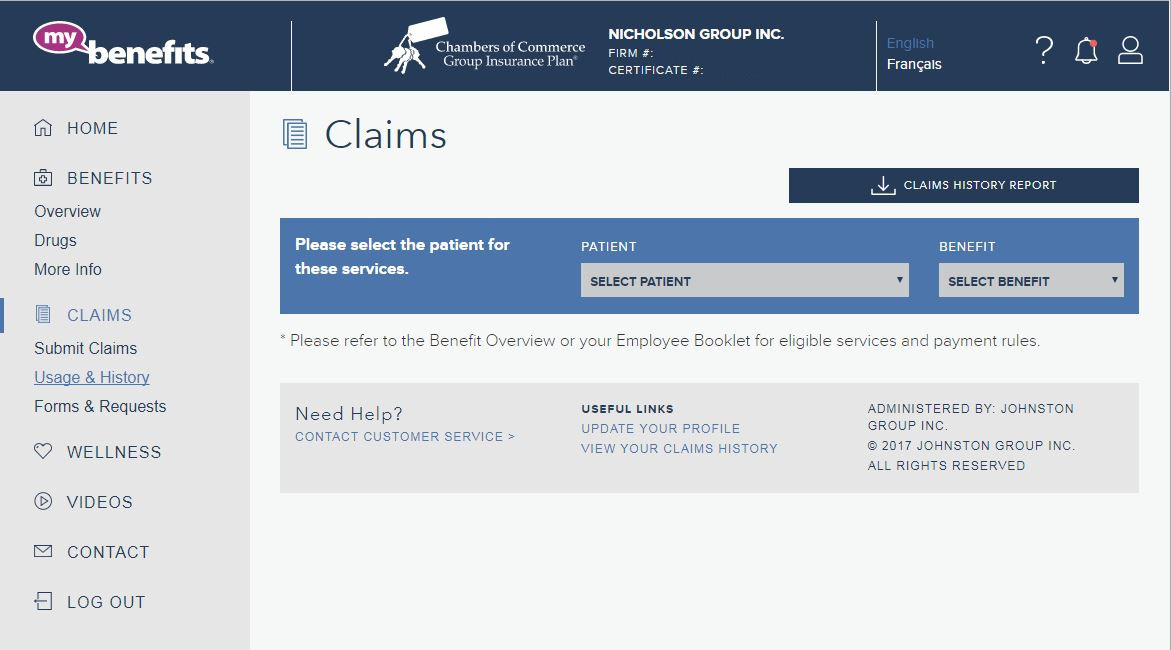

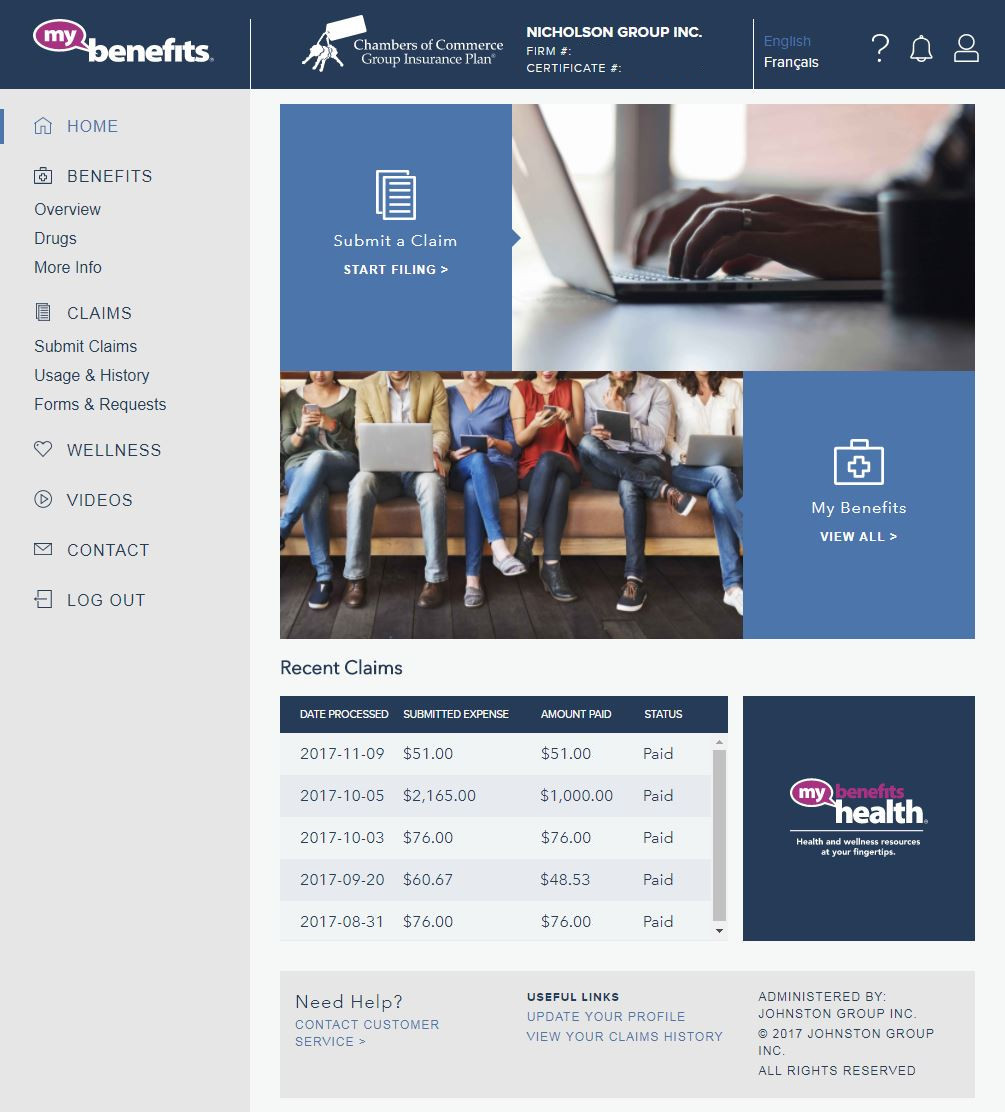

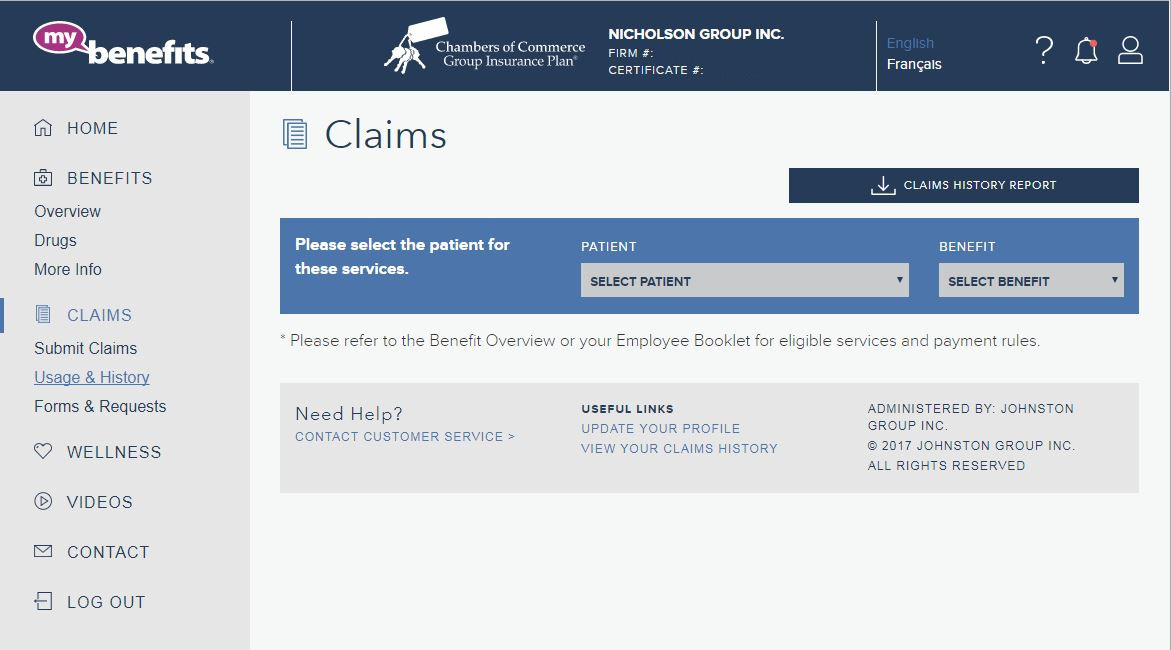

If you are looking to get your claims report for 2017 to use for your personal or business income tax purposes. Log into my-benefits.ca CLICK HERE Click on Usage & History Click on the Claims History Report button. Select January 2017 – December 2017 Print...

by Chris Nicholson | Dec 1, 2017 | Blog, Drugs, Group Insurance

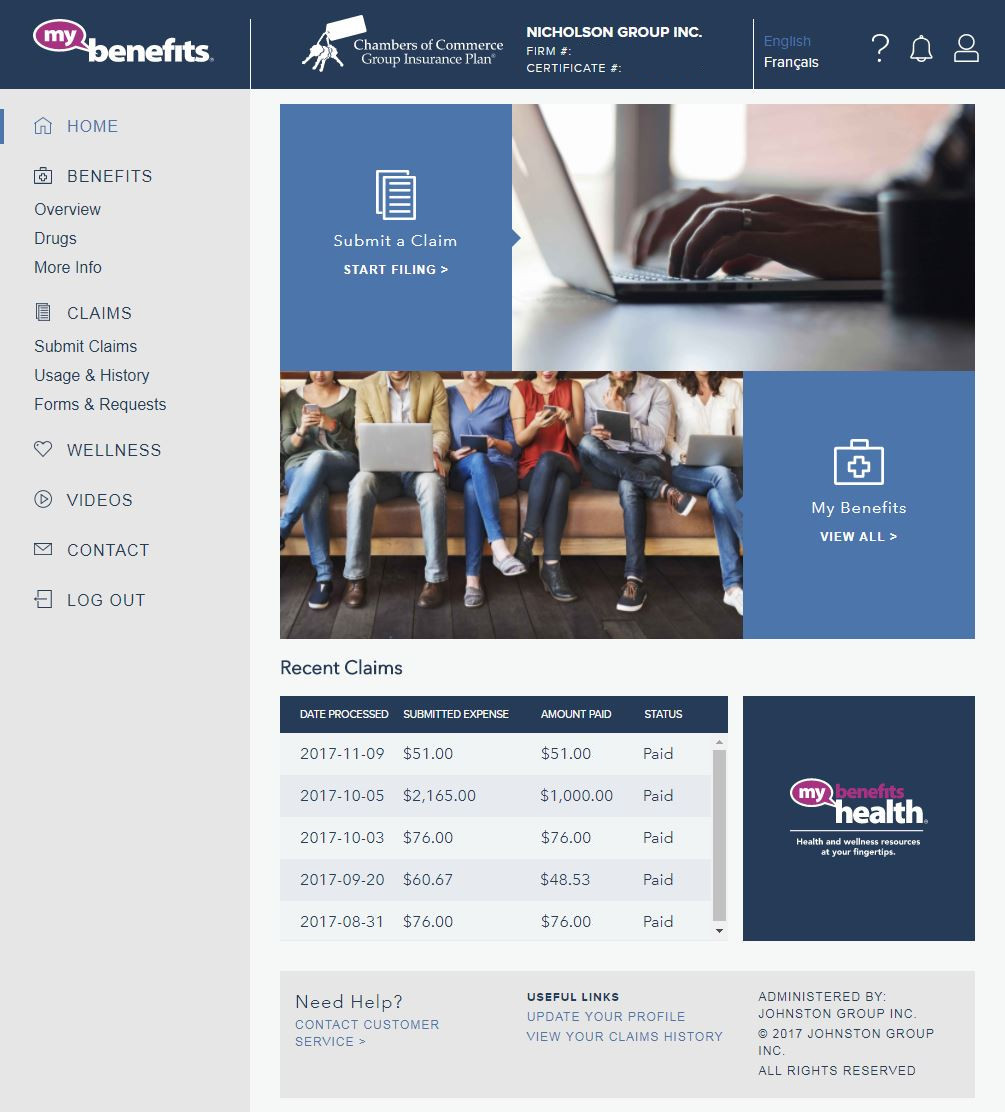

For Members of the Chamber Plan, Maximum Benefits or Johnston Group’s ContinYou or Retiree Plans the My-Benefits.ca website has had a fresh new update! It’s a high quality responsive design that works well on computer, tablets and phones, (There’s an...